Are buy-to-let investors finally catching a break? Tales of rising tax bills, swelling operating costs, and heaps of increased regulation have dominated the financial pages in recent years. But the start of a new calendar year has revealed some encouraging news for investors when it comes to rent. Particularly for those who happen to own property north of the border.

If rents are ballooning, however, why are buy-to-let investors leaving in their droves?

The exodus continues!

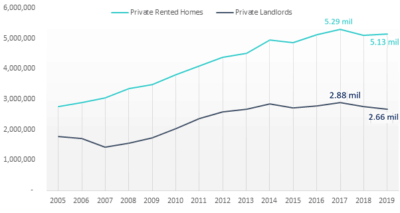

Data released today from Hamptons International underlines the scale of the landlord exodus in Britain. The number of buy-to-let operators fell 8% (or 222,570) in 2019 to 2.66m, the estate agency says, from the record peak of 2.88m in 2017. Last year’s figure is also the lowest for seven years when there were 2.58m investors knocking around.

Hamptons notes that “tax and regulatory changes have caused some landlords to sell up and leave the sector.” This caused the number of available homes for rent to drop to 5.13m last year too. This is also a reduction of 156,410 from those peaks of two years earlier.

Source: EHS, Gov.Scot, Stats Wales & Hamptons International

That Hamptons report revealed something curious though. While the number of landlords is in decline, the size of the property portfolio of those still involved is rising. The average UK landlord now owns 1.93 properties, according to the agency. This is the highest level since 2009 and is “a further sign that the sector is professionalising,” Hamptons says.

Better buys

This latest study underlines the growing financial strain the average buy-to-let investor faces today. Reports show that returns from the property rental sector have taken a hammering of late. And a growing number have little confidence that investing conditions are going to improve any time soon.

I certainly haven’t bothered with buy-to-let. Wanting a slice of the UK property sector, I instead decided to park my cash in FTSE 100 housebuilders Barratt Developments and Taylor Wimpey. Investing in those other Footsie shares Persimmon and The Berkeley Group is also a good option for long-term investors.

Getting rich the Foolish way

Firstly, buying Taylor Wimpey and Barratt didn’t require the sort of heaving up-front costs buy-to-let buying involves. I didn’t need to stump up a deposit, large solicitor fees, stamp duty, or a raft of other miscellaneous costs. I also knew I wouldn’t have to worry about how I’d pay back a mortgage if tenants failed to pay the rent, or during times when the property laid vacant.

The exceptional value these blue-chips offered was also hugely attractive. Forward P/E ratios that sat way, way below the FTSE 100 average of around 15 times. And truly-staggering dividend yields that mashed those of most other shares on the index.

Little has changed on either front since I took the plunge. Those four firms I mentioned offer payout yields ranging 5% and 8%. What’s more, each trade on very-attractive earnings multiples of between 11 times and 15 times too.

And with government getting tougher and tougher with landlords, I’d say that these stocks are more appealing than buy-to-let than ever before